NOTICE OF SPECIAL TOWN MEETING

Date: Sept 1, 2009

Place: Kearsarge Elementary School at Bradford; Old Warner Road, Bradford, NH

Time: 7:00 pm

Reason: ARRA Conditions for Grants; Tax Incremental Financing Districts

During this year, the town has investigated and applied for many grants, some funded by the American Resource and Recovery Act (ARRA) and others part of the State of NH Transportation Enhancement grant programs. Two major issues connected with these grants will be addressed.

1. The COPS grant – We did not receive funding on the first round but have not been denied. The next round will be addressed in the coming months. Should we receive an award, the town would receive funding for three years, but would need to agree to keep the officer for the fourth at our expense. This agreement needs to be voted by the town before we could accept money.

2. The Transportation Enhancement Grant (TE Sidewalk Grant). This grant requires the town to pay 20% of the cost, with the state contributing 80% to the project. At this time we do not have the complete 20% of the first phase in our capital reserve. By passing either the Tax Incremental Financing or the Registration surcharge, we can truthfully say the town is committed to funding the balance of the match and also implement some long term goals for other town improvements.

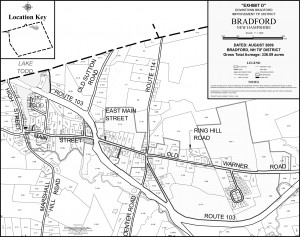

A public hearing will be held on the Tax Incremental Financing (TIF) District on August 11th at 6:00 pm in the Town hall. Money raised from this source would be available for sidewalk, roadway and municipal building (including the town hall) improvements within the district. On the reverse of this notice, you will find an explanation of how the TIF works.

An alternative funding source to the TIF would be to add $5.00 to the cost of each registration. This money would be earmarked for sidewalks and roadways only.

We urge you to attend to find out more about both options, and then come to town meeting on September 1st and vote.

What is a TIF?

TIF (Tax Increment Financing) a long term planning tool and is defined as the financing of public improvements with new incremental taxes generated by new construction, expansion or renovation of properties within a defined TIF district. Nothing is taken away from anyone because TIF districts use new money created by new investments. This is generated by property taxes on the value of the new (incremental) improvements and is set aside to pay for infrastructure and improvements in the defined district. Property owners in the district do not pay additional taxes.

Property tax revenue collected in the TIF district is split into two streams of revenue. The first stream is set at the original amount of the property value before improvements and goes where it did before to pay local, school, and county taxes. The second stream contains the additional tax money generated by the higher property tax value – “the tax increment”. This stream is dedicated to the TIF fund to pay for approved redevelopment and infrastructure. All monies raised within a TIF district must be spent within the same district. Funds from the “incremental assessed value” of improvements to properties within the described district would be set aside and used as match for state and federal funds and to carry out pubic projects within the district. This could include sidewalks, improvements to town hall, and construction of municipal buildings.

Please attend the August 11th meeting, at the town hall to learn more.

PDF of the proposed TIF District with lots included.